Financial statements help you make better decisions!

POSTED ON: Friday, November 16th, 2018

The Three Key Financial Statements:

Financial statements are not many people’s idea of a riveting read. They can test even the most passionate and committed SME owner managers. For many, the thought of a regular monthly review of the details of your company’s financial reports is distinctly unappealing.

However, spending time looking at the detailed performance is well worthwhile and will highlight areas for improvement, development and opportunity. Businesses are made and broken on the financial decisions that are made. Too many of them are made on gut feel, with very little account taken of data. The key business financial statements are a vital source of information.

Use Our Business Health Assessment

Are you making the right financial decisions for your business? Take our free test today!

Start Your TestThe journey to making better informed business decisions begins with an understanding of the three main financial statements. They are the profit and loss account, balance sheet and cash flow. These are readily available from most cloud-based accountancy packages like Xero, QuickBooks and Sage.

Comparing the performance to your annual plan (budget) will reveal quickly whether you are on track. Tracking performance versus budget, allows SME owner-managers and their teams to spot variances and quickly adjust plans. Relating performance to either the prior period (last month or quarter) or prior year will highlight trends and show up areas of improvement and deterioration. It is all too easy to prioritise a particular area (e.g. sales growth) and take the eye off other balls (e.g. cash).

The three financial statements that are most commonly used to make a business decision are the Balance Sheet, the Profit and Loss account (also known as a “P&L” or “Income Statement”), and the Cash Flow statement. Each has a very specific purpose and will give you an insight into a different part of the business.

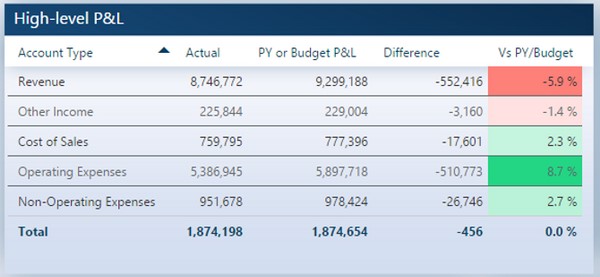

Profit and loss (P&L) or Income Statement:

This is perhaps the most common financial statement and the one most often read by SME owner-managers. However, taken in isolation it can be misleading and if compiled incorrectly it can be downright dangerous when it comes to your financial decision making process.

Critically, your income statement is not a statement of the cash generated. It includes intangibles such as depreciation and shows when revenue or costs are invoiced, not when cash is received, or when payables are actually paid. This means you’ll need to pay close attention to all areas of your business finances in order to make the right decision.

I met a business owner who told me, whilst gazing at a humongous amount of stock in his warehouse, that the P&L said he was profitable, but he never seemed to have any cash!

The income statement can be used to show how much money the business has made, but it will also provide guidance on where the strengths and weaknesses lie. This helps SME owner-managers control operating expenses and the cost of goods sold to keep profit margins intact. This kind of financial information is vital and invaluable to helping you drive success for your business by understanding how it performs.

From a strategic perspective, you can use the details of the P&L with financial decision making to focus on doing more of what works best for your business and less of whatever is diluting performance or eating into your bottom line.

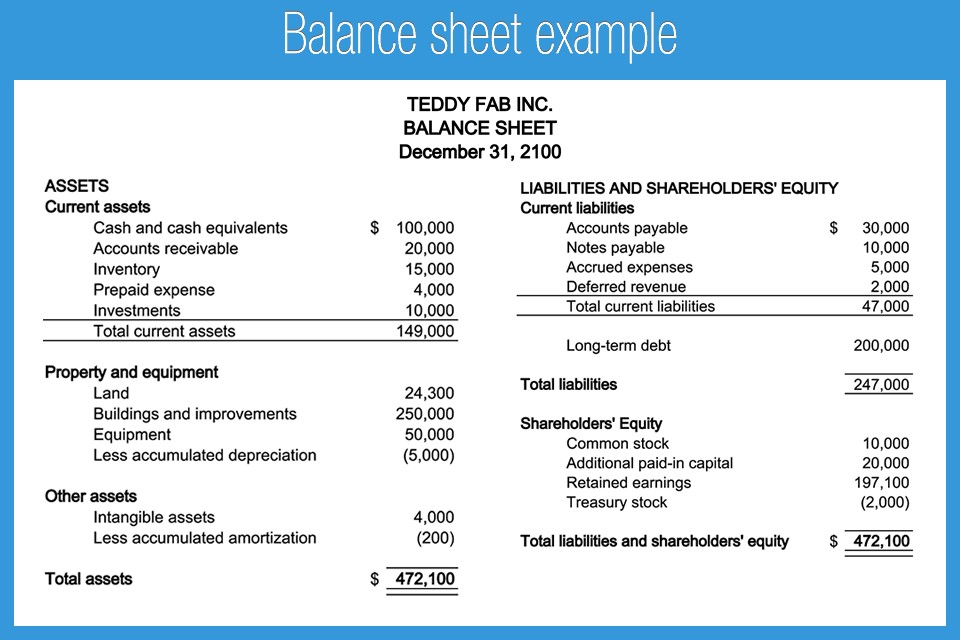

Balance sheet:

My first chairman eschewed the P&L in favour of the balance sheet as their preferred financial report of choice, on the basis that this is where the real power lies. The balance sheet shows you a snapshot of how much money the business has (sources of funds), and how that money is deployed in terms of what it has (assets) and what it owes (liabilities). This allows you to make the right financial decisions based on the information you actually need. The overall balance (net assets) and the where the amounts of money sit enable you to manage the business finances to ensure that you have enough cash to support the company whilst building the company value in a sustainable manner.

I recently looked at an SME’s balance sheet and was appalled at the lack of cash in the business because of the amount of uncollected money on overdue invoices with customers. The business was acting as an interest-free bank to its customers and paying dearly, relying on factoring of invoices, overdrafts and top up loans from shareholders. Without a balance sheet in place, it’s all too easy to miss these important areas and suffer from oversights that could cost your business dearly. Make sure you have the key financial information to hand in a way that’s easy for you to understand, to inform your decision making process more clearly.

The balance sheet as a financial report can help drive many business decisions. Example: Your business generates £1.5 million in annual sales. The balance sheet indicates that there are 3 months of sales in accounts receivable. Simply by changing credit policies within the company and focusing on collecting money when it is due, so that most receivables are resolved within 30 days, could release £250,000 of cash into the business.

A good business manager can see possibilities for growth and efficiencies behind the numbers in the balance sheet, giving them the financial information they need to make the right decisions.

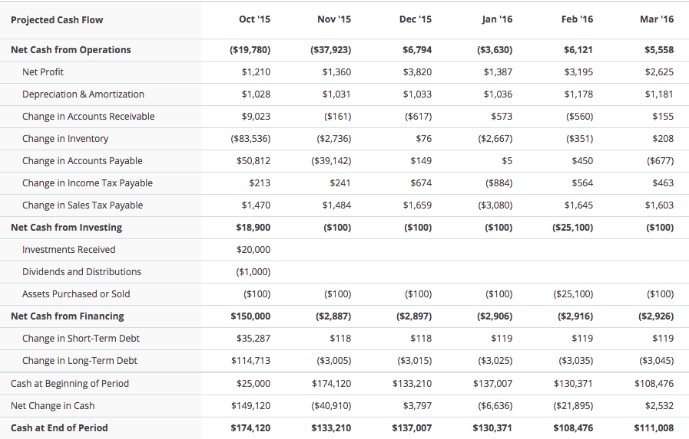

Cash flow statement:

For small businesses, the importance of the cash flow statement and associated forecast cannot be overstated. They are vitally important to enable effective financial decision making. Cash flow figures should be familiar to SME owner-managers because bumps in the road can quickly become major headaches and potentially fatal problems for the unprepared.

Your business may look profitable on the P&L; however, the cash flow statement will alert you to whether the company has enough cash to pay its bills. This is, of course, one of the most important considerations for your business finances. A drop in the company’s operating cash-flow should cause alarm bells to ring, perhaps indicating a need to raise pricing, reduce inventory, squeeze overheads, or any number of other short-term decisions to improve the company’s cash position. A growing top line and efficient operations are all very well but without a steady and predictable cash flow, even the most viable of businesses will struggle for survival.

One business owner showed me his cash statement and it became obvious that there were problems ahead. They ended up asking HMRC for permission to stage VAT payments and had to delay corporation tax because they simply didn’t have the money. In order to avoid these kinds of situations, make sure you have the necessary financial reports available. You’ll need all the information you can. You don’t want to end up making financial decisions because you have to; you want to be able to make the right ones to enable your business success.

In many small businesses, a focus on cash flow numbers is not just prudent but critical to survival.

Regular monthly reviews:

A regular monthly review of the business’s financial statements will help you make appropriate decisions to

- Increase sales

- Raise profitability

- Purchase new capital assets

- Reduce costs, etc.

I worked with a business that made a strategic decision to develop a new line of business in its existing marketplace. However, they got their pricing wrong and ended up making a thumping loss in the first year of the new venture. The data and financial decisions that informed this pointed to gross margin being the issue and looking at the costing model revealed a basic mistake. Fortunately, the market was not price-sensitive and correcting the model and increasing the price accordingly almost overnight turned a loss-making venture into a profitable enterprise.

Without this financial information to draw upon, it can be difficult to know why your business isn’t succeeding in the way you want it to. You need all the data and variables in one easily accessible financial report to understand what needs improvement – as well as what’s going well, of course.

Assess the state of your business finances and how well you are managing them:

We recognise that finance is not within the comfort zone for many SME owner-managers. Financial statements can be a mysterious or even daunting prospect to understand, let alone put together, and many small businesses don’t have a properly qualified leader of their finance function. Indeed for many, it sits with the business owner and an outsourced bookkeeper.

Pro-actions business coaches can help you to understand how healthy your business is in all aspects, from strategy and leadership to statements and financial reports. Take our free Business Health Assessment to get a comprehensive overview of how your business is performing – and how you can improve with the help of our expert business coaches and consultants. You will then be in a position to assess where you are and make improvements with regards to financial statements, decision making and much more. As always, Pro-actions coaches are available to help you work through where to go next.

Summary:

Whether your plan calls for taking advantage of fresh opportunities, enhancing the value in your business to prepare for sale or fending off creditors long enough to survive, the regular review of financial statements will provide a vital insight into how things are going. It’s all about making proactive business decisions based on what really matters most in your specific situation.

Being familiar with the three key financial statements; the Balance Sheet, the Profit and Loss account (also known as a “P&L” or “Income Statement”), and the Cash Flow statement will provide an SME owner-manager with deep insight into their business. Pro-actions recognise that not everyone has been taught how to read these important documents and make key financial decisions based on them. We regularly meet SME business owners who rely on their accountants to prepare a once per year set of statutory accounts and then sign them off “blind”. Like most things, financial statements are a matter of familiarity. Let us help you gain more insight into financial statements and, as a result, your business as a whole.

Take the first step towards understanding your business finances and improving your decision making with our free online Business Health Assessment.

If you need help with understanding your financial position and performance, contact us to set up a complimentary business review.

Get Expert Advice on Your Business' Finances and More!

Book a Free Business Advisory Session Here!

Talk to Pro-actions business advisors to discuss your past and future financial decisions to drive success. We have a wealth of experience to draw upon guiding SME owner-managers towards continued growth and profitability!

Book Here!