Making your numbers work for you

POSTED ON: Wednesday, February 17th, 2016

CATEGORIES: Finance

Why is that some, not all, business people have such trouble in understanding their financial statements, do not produce management accounts or believe that they don’t have need to know the numbers that are being created out of their activities.

How many times have I heard from business people that “I have a bookkeeper (wife sometimes) to do the numbers, or my accountant handles that”.

Perhaps it is because they have not taken the opportunity to understand what numbers are important to their business and the power that knowledge could bring them.

How is it that the market trader, whether it be on a stall or in a bank dealing room, have an image of being slick and able to rip us off with their deals. Basically they are dealing in numbers and understand the impact of small but significant changes either in price or volume.

The importance of numbers

Let’s take a simple illustration of the market trader, able to move with the marketplace and respond to demand quickly, just like the foreign exchange or commodities dealer.

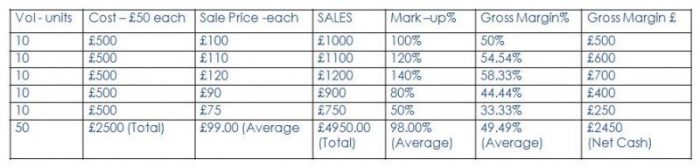

Del Boy has bought some watches at £50 each and is selling them initially at £100 each. Here is a summary of his day. I’ve put his numbers into a table to help your understanding.

The first 10 watches fly off the stall in quick time. Perhaps I’ve priced them too low he thinks.

Not wanting to be greedy he decides that he will try an increase of just 10%, he can always knock it back if it doesn’t work.

The morning continues in a positive manner such that he feels able to increase the prices again to £120 each.

So looking at his initial morning trade after his increase in price he has sold 20 watches that have cost him £1000 and he has sold them for £2100 a great margin of £1100 and average Gross Margin % of 52.27%.

However good those numbers are what was the impact of increasing prices. If he had stayed at the 50% margin he would have lost, effectively, £100. But the relationship of this extra £100 to the initial batch sold is interesting. He made an extra £100 profit but his average gross margin only increased by 4.5% but the £100 extra received was a 20% increase on what he had received from the first batch.

So a 10% increase in sale price has brought about a 20% increase in the cash he received from the sale of the second batch.

However demand starts to slow after lunch and the market closes in a few hours. He reduces the price to try and move the stock a bit quicker so he is now selling at 10% below the original price at £90 each. The results are the same, but in reverse, as the increase. The 10% reduction leads to a 20% reduction in cash received.

Getting to the end of the day and with rain starting he reduces the price even further and his mark up is reduced to 50%, which results in a Gross Margin of 33.33% and his take home cash for this last batch is just £250, which not surprising is 50% less than he received from the first batch. However he has cash in his pocket has sold all his stock and can enjoy his evening.

But being the good businesses person that he is he reflects on his day. He realises that it is not the sale price that is important to him but how much cash he will generate from each sale (Gross Margin), to buy more stock and cover his overheads. Fortunately he knows the number that his breakeven sales level is (do you?) so he knows exactly how much net profit he has made that day.

Whilst this is a simple example the batches could relate to different products with different costs and potential for sale, over different time spans.

Using numbers whether it is in respect of volumes, percentages or just simple amounts can open up another dimension to making a business perform better.

If you would like to meet with a Pro-actions coach or would like a telephone call to discuss any aspect of your business, please contact us today!